In accordance with a brand new evaluation of house owners insurance coverage charges, some Midwest states noticed the most important jumps in premiums final 12 months—and American Household Insurance coverage topped an inventory of 10 insurers ranked by common price change.

The evaluation revealed by S&P International Market Intelligence this week is predicated on owners price filings permitted by means of Dec. 27, 2024—so not fairly the entire 12 months final 12 months.

In accordance with S&P GMI, the calculated weighted nationwide common efficient price improve for owners insurance coverage was 10.4% final 12 months by means of late December. In 2023, the comparable determine was 12.7%, placing the two-year common improve at roughly 24 p.c.

The state for which S&P GMI calculated the most important efficient price will increase for 2024 was Nebraska with 22.7%. In whole, 33 states had double-digit calculated efficient price will increase final 12 months, with charges in Montana, Iowa, Minnesota, Utah and Washington additionally rising greater than 20% by S&P GMI’s calculations.

Minnesota and Iowa had been additionally among the many states with the best direct loss ratios in 2023 (together with protection prices), though Hawaii, Kentucky and Arkansas had been worse.

On the opposite finish of the spectrum, Florida had the bottom—at 1.0%—however the textual content of the report notes that Florida’s calculation doesn’t embrace any adjustments by Residents Property Insurance coverage Corp., the state-backed insurer of final resort.

For American Household, which raised charges in 42 states final 12 months, the provider’s three largest weighted-average price will increase occurred in Missouri (30.1%), Illinois (27.5%) and Nebraska (27.1%), the S&P GMI report says.

Concerning the Evaluation

Charge submitting data for S&P GMI’s evaluation was sourced from System for Digital Charge and Type Submitting paperwork and is restricted to owner-occupied owners price filings of every state’s 10 largest home-owner underwriters primarily based on 2023 direct premiums written plus any of the nation’s 10 largest home-owner underwriters outdoors the state’s prime 10, excluding state-backed insurers of final resort like Residents Property Insurance coverage Corp. of Florida in addition to mobile properties, rental and condominium strains of enterprise.

The calculations are primarily based on price filings entered into the database by means of Dec. 27, 2024, for 49 states plus the District of Columbia. Wyoming was excluded as a result of a restricted variety of price filings.

Whereas the Wisconsin-based mutual insurer pushed charges up greater than 31%, on common, countrywide within the final two years, the most important home-owner insurer, State Farm, ranks in the midst of the pack by way of price hikes with a two-year common improve of lower than 20% throughout all states.

In truth, whereas the ten insurers analyzed by S&P GMI elevated owners charges by about 45% over the six-year interval from 2019-2024, State Farm scored the bottom six-year bounce at 24%.

One other mutual, Liberty Mutual, applied the second-highest weighted-average price change calculated by S&P GMI throughout the nation, at 14.5% in 2024, and the most important two-year bounce (of about 37%).

The textual content of the S&P GMI report gives extra details about the states during which Liberty Mutual, Progressive and Farmers boosted charges probably the most, and features a state-by-state chart itemizing general common price adjustments for the ten insurers mixed for every of the years 2019-2024.

Profitability Improves

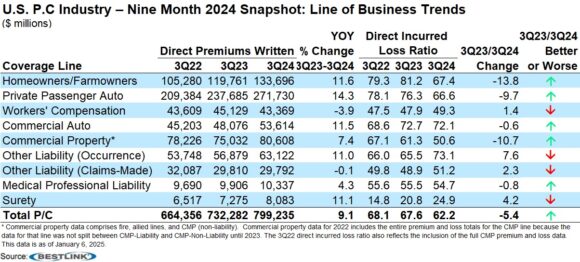

Individually, ranking company AM Finest revealed an evaluation of loss ratio adjustments by line by means of the primary 9 months of 2024, discovering that owners was probably the most improved line, pushed by an aggressive push for charges.

Total, the owners loss ratio skilled a 13.8-point enchancment through the first 9 months of 2024, in comparison with the identical interval in 2023, in response to the report titled “3Q24 Snapshot: Private Strains Propels Enchancment in Direct P/C Business Underwriting Outcomes, which summarizes information derived from U.S. P/C carriers’ third-quarter statutory statements (acquired and aggregated as of Jan. 6, 2025).

Throughout all strains, the loss ratio dropped 5.4 factors, and AM Finest mentioned the considerably improved direct underwriting outcomes had been pushed by elevated earned premiums, which have outpaced the rise in incurred loss and loss adjustment bills, and different underwriting bills.

“The private strains section noticed probably the most notable enchancment, benefiting from an aggressive push for extra satisfactory charges, pricing segmentation in private auto, the influence of underwriting initiatives and improved disaster threat administration practices,” AM Finest mentioned, noting that the development for the owners line got here regardless of Hurricane Helene, which impacted third-quarter outcomes.

David Blades, affiliate director, Business Analysis and Analytics, AM Finest, famous that though the nine-month outcomes present “optimism for full-year direct and web outcomes, Hurricane Milton, which occurred within the fourth quarter, is predicted to have a larger influence on owners and business property outcomes than Helene.”

Industrial property was the second-most improved line by way of underwriting revenue, with the loss ratio for that line dropping 10.7 factors.

Shut behind, the private auto section’s direct loss ratio by means of third-quarter 2024 improved by practically 10 share factors and skilled an industry-leading 14% improve in direct premiums written.

Direct premiums written throughout the property/casualty {industry} had been up by 9.1% in contrast with the identical interval in 2023, barely beneath the ten.2% improve by means of third-quarter 2023.

Earlier this week, Vacationers, the primary publicly traded insurer to announce full-year earnings, reported elevated underwriting earnings for the corporate general, however the largest mixed ratio enchancment was a ten.4 level year-over-year drop for its private insurance coverage section (10.7 factors for owners and 10.0 factors for private auto).

Vacationers full-year mixed ratio for the owners line landed at 93.9, regardless of greater than 24 factors of disaster losses. The provider reported renewal premium adjustments averaging 14.1% within the fourth quarter of 2024.

Subjects

Developments

Pricing Developments

Owners