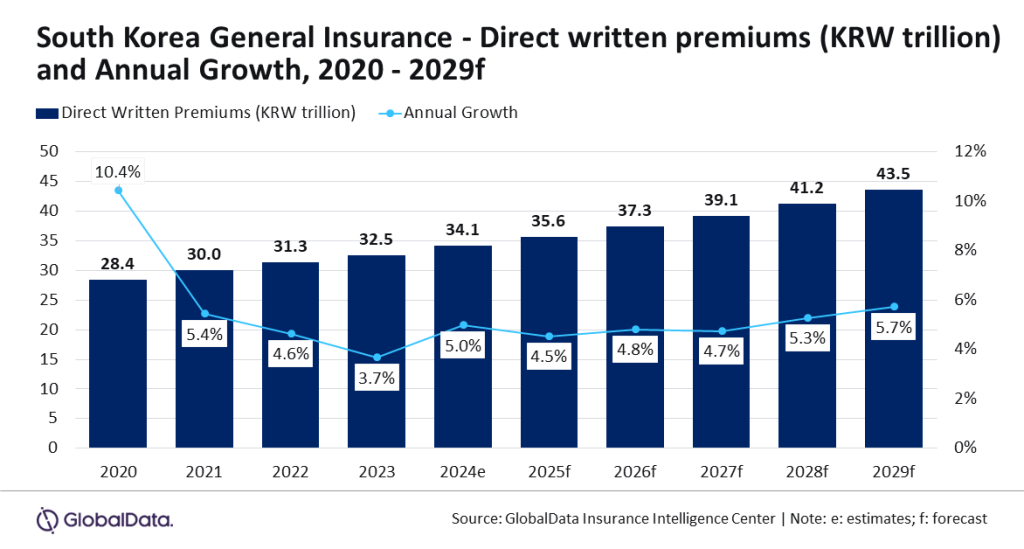

The overall insurance coverage trade in South Korea, by way of direct written premiums, is predicted to develop at a CAGR of 5.2%, from KRW34.1trn ($26bn) in 2024 to KRW43.5trn ($33.3bn) in 2029.

The expansion is pushed by by financial restoration, obligatory insurance coverage laws, and a heightened concentrate on information safety.

That is in response to GlobalData, which additionally forecast that South Korea’s common insurance coverage trade is estimated to develop by 5% in 2024, pushed by obligatory strains of insurance coverage and elevated consciousness for information safety, resulting in greater demand for legal responsibility insurance coverage merchandise.

Aarti Sharma, insurance coverage analyst at GlobalData, feedback: “The South Korean common insurance coverage trade could face potential premium worth will increase within the short-term because of the escalating geopolitical disaster within the Center East that may probably affect the costs of vital commodities, given the nation’s excessive reliance on commerce.”

Motor insurance coverage is the most important line of enterprise, which is predicted to account for 59.9% share of the direct written premiums in 2024. It’s anticipated to witness a slower progress of 1.7% in 2024 resulting from a decline in automobile gross sales.

Legal responsibility insurance coverage is the second main line with a 13.7% direct written premiums share in 2024. It’s anticipated to develop by 12.2% in 2024, propelled by favorable regulatory developments and obligatory insurance coverage lessons for each people and companies, encompassing third-party legal responsibility {and professional} indemnity insurance policies.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we would like you to take advantage of

helpful

determination for your enterprise, so we provide a free pattern that you may obtain by

submitting the beneath kind

By GlobalData

Sharma concludes: “The overall insurance coverage trade in South Korea is poised for regular progress, pushed by an financial restoration and obligatory insurance coverage necessities. The trade’s resilience and adaptableness to altering market circumstances and expanded scope for legal responsibility insurance coverage are prone to contribute to the trade’s progress trajectory within the coming years.”