Leap to winners | Leap to methodology

Velocity demons

Brokerages have two principal avenues for development, however it’s natural growth that instructions the business’s focus.

This, in response to Sean O’Neill, head of the worldwide insurance coverage observe at Bain & Firm, is the sector’s “holy grail” – a mark of sustainable success that companies are more and more striving to achieve.

“The main brokerages have labored to allow dealer productiveness by decreasing time spent on administrative actions to unlock time for client-facing actions,” he says.

“Most of this has been within the consolidation of center and back-office actions, however we’re additionally beginning to see the early shoots of success in expertise enablement of entrance workplace and extra bespoke dealer actions.”

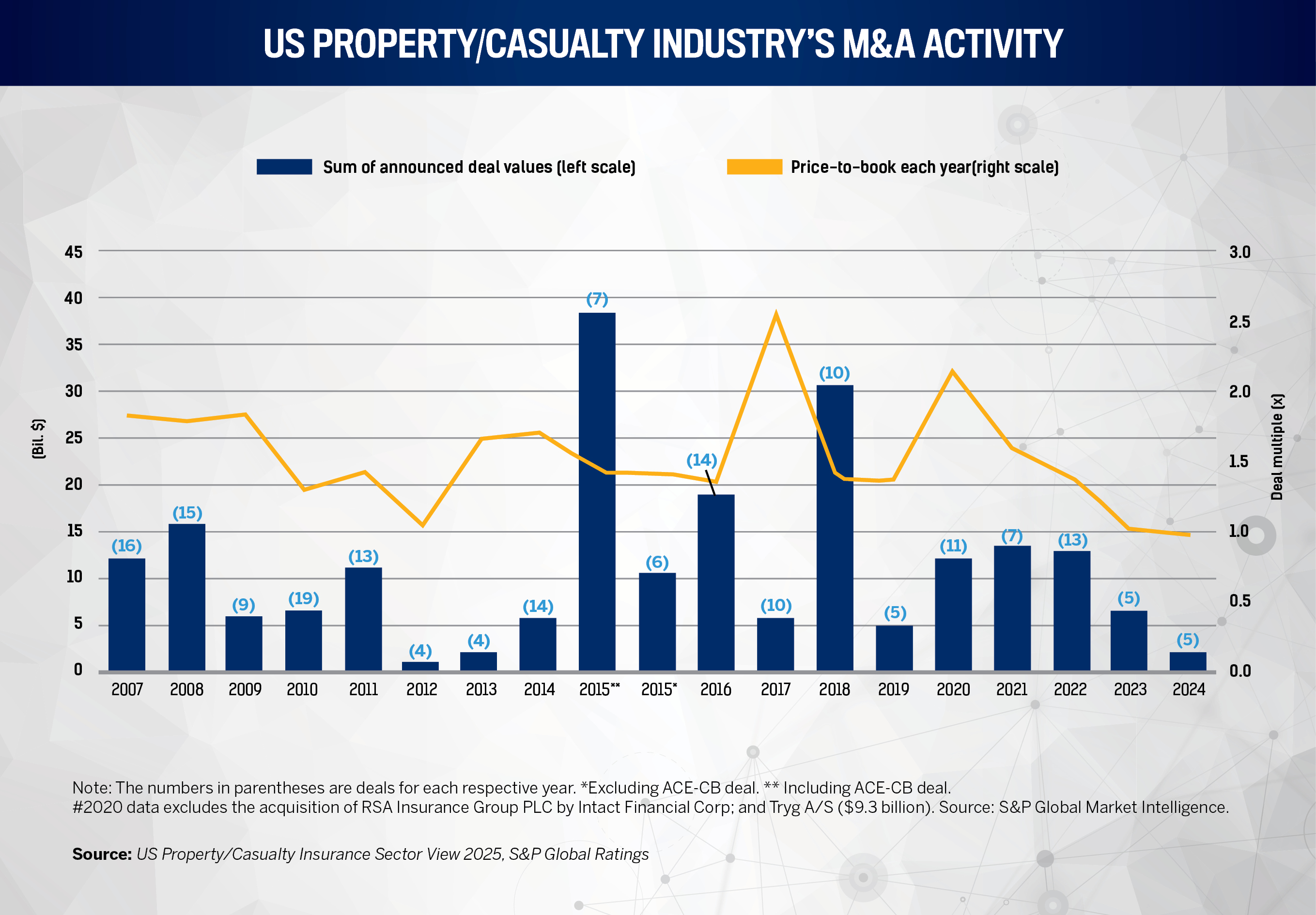

Whereas the opposite path to development is by way of acquisitions and consolidation, that has been prevalent throughout the business and is anticipated to decelerate.

It’s nonetheless occurring, although. For instance:

-

January 2025 – Ryan Specialty acquired Velocity Threat Underwriters from funds managed by Oaktree Capital Administration LP for $525 million.

-

March 2025 – Steadiness Companions introduced the acquisition of Vanguard Specialty.

-

March 2025 – NEXT Insurance coverage was acquired by Munich Re’s ERGO for $2.6 billion.

MarshBerry’s Pete Kampf pinpoints specialty insurance coverage as the principle driver of consolidation. He says, “Following 2023’s all-time excessive of 181 specialty insurance coverage middleman transactions, 2024 skilled 120 whole transactions, representing a 33 p.c decline …. The specialty middleman mergers and acquisitions (M&A) market stays steady: the continued outpacing of demand over the provision of high quality sellers.”

Joshua Morley, chairperson and co-founder of Ori-gen Company Insurance coverage, underlines what defines progress. He says, “Is inorganic development actual development? I believe that’s the laborious half to outline.”

Morley factors to a key driver of natural development as tapping into area of interest markets. He offers the instance of taking a subset of the development business, specifically, African American, Latino, or Asian American contractors that may very well be underserved.

“For lots of unbiased brokers that aren’t the larger or regional outlets, taking a look at these subniches can actually transfer the needle when it comes to rising organically, and that’s simply talking from our expertise of discovering these subniches or ethnic niches inside the business,” he explains.

Together with tapping into area of interest markets, the opposite enabler for brokerages to develop is by leveraging tech. Brokers are actually coping with growing quantities of knowledge from sources corresponding to related units, higher-fidelity climate and vegetation information, however lots of it’s unstructured and generative AI has proven early promise in tapping into this potential.

“We see the leaders working to entry this effectively and to leverage insights to drive dealer effectiveness, guarantee protection adequacy,” says O’Neill. “The main gamers acknowledge this isn’t only a expertise answer but in addition understand that it’ll contain modifications throughout folks, course of, and information to unleash the actual potential.”

Mark Todd, advertising and marketing/public relations chair of the Nationwide African American Insurance coverage Affiliation and director of strategic partnerships at Ori-gen, explains that some duties that used to take days are actually accomplished extra rapidly, with insurtech being so highly effective on account of its pace and accuracy.

He says, “We’ve bought some firms we’re working with that assist with information mining and serving to put collectively your proposals, doing coverage comparisons, and placing it on a spreadsheet.”

However he provides how laborious it may be to develop income whereas staying on prime of present shoppers. For Morley, there’s a must embrace tech within the acceptable approach, as a result of he feels the main brokerages develop by understanding what issues.

“We’re the connection. We’re the data, the belief, and so it’s a must to have a look at expertise, to not clear up all of your issues,” he provides. “No matter you’re utilizing doesn’t substitute what you’re truly the most effective at.”

Insurance coverage Enterprise America’s Quick Brokerages 2025 have remained true to their founding rules and delivered excellent service, which has been the bedrock of their development. All of this yr’s winners recorded not less than a 15 p.c rise in income.

Powering the agency’s success is the chief group’s deep expertise as brokers. They perceive what it’s prefer to be on the sharp finish and be certain that flows by way of the enterprise.

Chief working officer Peter Carpenter factors to a lot of profitable brokers at all times eager to hitch Alliant, which he refers to as “an natural development machine”. He started by beginning a brokerage 3,000 miles from house in Seattle.

“We spent our 10 years road preventing to attempt to achieve market share earlier than we offered it to Alliant,” he says. “There’s a distinction between university-credentialed folks entering into these positions to run companies which have by no means handled a consumer. We all know what it’s to do this and it oozes by way of our agency and it’s the previous adage – a fish stinks from the pinnacle down.”

Proving the purpose, longstanding and just lately retired CEO Tom Corbett was a profession dealer, whereas many of the different leaders have had related skilled paths.

Technique has pushed Alliant’s income development and it differs from their opponents’ strategy. Whereas they might look to institutionalize shoppers by disconnecting them from their dealer and changing into connected to the general firm, Carpenter and the group imagine within the reverse. They need the shoppers and brokers to stay shut and keep belief, whereas Alliant diligently connects to the brokers with out forcing their model on shoppers.

“We work actually laborious to ensure that these folks which can be on the market with the shoppers are institutionalized at Alliant, that they love being right here they usually’re collaborating within the upside of the enterprise,” says Carpenter. “I’m not going to go name and say, ‘Hey, I’m Peter the COO, so you must love Alliant.’ The dealer is the one motive they’re right here and I’ve lived that, so I get it.”

Group ethos

Alliant deploys a flat hierarchy, so staff have prepared entry to the chief group. This not solely empowers everybody however permits brokers who already perceive the business and their shoppers to proceed working collectively seamlessly. Alliant avoids asking for meaningless stats or putting arbitrary targets on their folks, like some business gamers do.

“We’ve got folks with large consumer bases who’re unimaginable professionals they usually may run their very own companies,” says Carpenter. “They’re not going to reply to somebody who flamed out and desires to know what number of chilly calls they made final week. It’s ridiculous to do this.”

Compensation can be used as an incentive to encourage staff. Alliant is greater than 50 p.c internally owned, which is uncommon for a corporation with a valuation of over $20 billion. This management means the chief group ensures they put brokers first and by no means lose sight of that.

“To an individual, out of almost 1,000 brokers which have joined us over the past 11 years, they’re all saying, ‘My shoppers are higher off right here’”

Peter CarpenterAlliant Insurance coverage Providers

Carpenter says, “Most of those personal fairness companies are directing the organizations into what they need to see, and you’ve got sort of ‘ivory tower’ choices being made about how the companies ought to run, versus having respect for the folks within the area understanding what they’re doing.”

And he provides, “The way in which we equitize folks is predicated on success, not your final title or who your buddy is within the agency. It’s about efficiency.”

Whereas Alliant is structured to be totally compliant and shares finest observe throughout all of its 14,000-strong group, the agency is towards the substitute flexing of forms. Each its hierarchy and compensation positions work collectively to supply incentives, but in addition area to thrive.

“It’s this symbiotic factor of ‘I respect you and also you respect me,’” says Carpenter. “Let’s be in our lanes and work collectively the place we have to, and let’s not have me sit in your head while you don’t want me to.”

Nevertheless, the surroundings comes with the expectation that those that be a part of will seize the chance. There may be area to run and for brokers to point out their worth.

“It’s not a terrific place to be mediocre,” admits Carpenter.

Progress is a continuing at Alliant, with the agency centered on persevering with its momentum. Alliant hasn’t wanted to overpay for acquisitions as a result of it will possibly depend on its repute and mannequin to draw brokers who need to develop. The incoming brokers are instructed what to anticipate and allowed to work inside that.

Carpenter says, “Our success ratio with the those who be a part of us is thru the roof as a result of it’s slightly self-screening. You’re coming right here since you’re going to have the ability to do approach higher for your self and your shoppers.”

Some development additionally comes from mergers as brokerages be a part of Alliant and, once more, these house owners are attracted by going someplace they know an unbiased tradition will stay, in comparison with promoting to a bigger group which will need to change and implement a brand new approach of doing issues.

“We’re made up of people that have sought refuge from these different locations. There’s no path to Alliant changing into half or doing a cope with Aon or Marsh,” provides Carpenter.

Unwavering customer support is the core driver for the New York-based agency. It’s the linchpin behind Hirschfeld and Associates’ multi-year development plan, outlined by key efficiency indicators that it constantly achieves:

Each present the flexibility to make sure shoppers are effectively protected and glad, but in addition the flexibility to supply tailor-made insurance coverage options that meet consumer wants at aggressive worth.

Past merely providing a coverage, the agency conducts analysis to current the very best product accessible out there that aligns with the shoppers’ particular necessities. They implement a method constructed across the precept of treating every buyer as if they’re the one buyer.

Founder and president Joel Hirschfeld says, “This isn’t only a slogan; it’s implanted in our values. We obtain this by dedicating important time to actually perceive every consumer’s distinctive wants, each private and enterprise.”

An extension of the dedication to service is best protection, which the agency feels usually has an excessive amount of of a transactional nature.

“The rationale behind that is easy: in immediately’s advanced world, off-the-shelf insurance policies usually depart gaps in safety,” says Hirschfeld.

Brokers are educated to conduct thorough danger assessments for every particular person and enterprise consumer. Based mostly on this evaluation, the agency works with its service companions to assemble custom-made insurance coverage packages that present essentially the most complete and cost-effective safety for his or her distinctive exposures.

An instance of the place that is being utilized is within the elevated want for cyber legal responsibility protection.

Hirschfeld says, “We’ve invested in coaching our group and constructing relationships with carriers who specialize on this space to make sure we are able to supply sturdy options to our enterprise shoppers.”

Changing into larger

As a fast-growing agency, Hirschfeld and Associates has added new brokers however upholds two non-negotiable qualities:

Group members are advocates of customer support centered on constructing rapport, speaking clearly, and prioritizing shoppers’ wants. And the data ensures brokers grasp the intricacies of merchandise and might clarify them successfully.

These qualities are strengthened by an onboarding program.

“It includes a mixture of formal coaching on our programs and product choices, mentorship from skilled brokers, and a robust emphasis on shadowing and hands-on studying,” says Hirschfeld. “We additionally dedicate time to reinforcing our customer support philosophy and making certain they perceive tips on how to ship the ‘treating every buyer as if they’re our solely buyer’ expertise.”

Expertise can be used to streamline processes and unlock brokers’ time to give attention to consumer interactions. There’s a sturdy emphasis on inside high quality management and overview of processes to make sure the protection really helpful is acceptable and correct.

“We don’t view insurance coverage as a commodity; we see it as an important safety for our shoppers’ lives and companies. This attitude drives our group to go above and past”

Joel HirschfeldHirschfeld & Associates

As well as, the agency actively solicits consumer suggestions by way of direct communication to determine areas for enchancment.

Acquisitions are one other pillar of development, however they’re solely undertaken when the corporate feels it is going to develop its capabilities to serve a wider vary of consumer wants.

Hirschfeld and Associates actively seeks companies that supply a broad spectrum of insurance coverage merchandise – from private strains, corresponding to house and auto, to industrial strains protecting varied industries.

“The objective is to accumulate companies that complement our current choices and permit us to supply a extra complete suite of options to our shoppers,” says Hirschfeld. “This ‘all forms of protection and all potential markets’ strategy is strategic. It allows us to turn into a one-stop store for our shoppers, growing their loyalty and our market share by with the ability to tackle a wider array of their danger administration wants.”

- 925 Companions

- ALKEME

- BOSS Bonds Insurance coverage Company

- Boxwood Insurance coverage Group

- Capstone Group

- Harbour Insurance coverage

- Higginbotham

- Hirschfeld & Associates

- IMA Monetary Teams

- J. Krug & Associates

- McHugh Insurance coverage Group

- One80 Intermediaries