The authorized career has skilled many transformations over the previous yr, however maybe none as dramatic as the basic shift in how authorized professionals method insurance coverage protection. In a shocking reversal from earlier years, 45% of authorized professionals are actually upgrading their insurance coverage insurance policies, a staggering leap from simply 14% who had such plans in 2024. Whereas different legislation agency developments have stunned us this yr, this one might take the cake.

This shift displays a reimagining of how authorized professionals view safety, danger, and strategic enterprise planning. The legislation agency developments from our 2025 Authorized Threat Index reveal a career that’s shifting from reactive protection buying to proactive danger administration, treating insurance coverage not as a needed operational expense however as a strategic enabler of development and innovation.

From Underinsured to Strategic

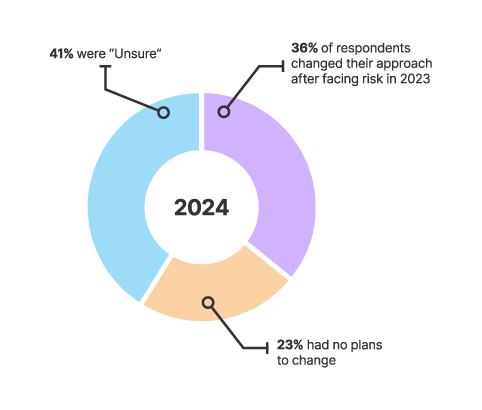

The shift is exceptional when seen towards the backdrop of earlier years. Authorized professionals traditionally reported feeling underinsured whereas concurrently missing concrete plans to deal with protection gaps. The business appeared caught in a cycle of understanding they wanted higher safety however struggling to translate that consciousness into motion.

That cycle is displaying indicators of breaking. The threefold improve in professionals upgrading their insurance policies indicators a significant change in how authorized professionals perceive the connection between safety and alternative. This seems to be pushed by the popularity that complete insurance coverage protection doesn’t constrain enterprise development; it permits it.

The arrogance stage accompanying this shift is equally placing. A powerful 77% of authorized professionals now specific confidence that their present insurance coverage insurance policies cowl their biggest enterprise dangers, representing a dramatic enchancment in each protection adequacy {and professional} consciousness of what that protection really offers.

The Excellent Storm of Consciousness

So, what drove this pattern? It seems to be a mixture of things that created each urgency and alternative for protection enhancement.

The speedy adoption of AI applied sciences, leaping from 22% to 80% utilization amongst authorized professionals, launched new legal responsibility exposures that present insurance policies might not have adequately addressed. As corporations started integrating AI instruments into their day by day operations, the potential for skilled legal responsibility claims associated to over-reliance on know-how or information privateness breaches turned actual issues quite than theoretical dangers.

Concurrently, the shift in inside danger priorities from monetary pressures to reputational and employment-related challenges highlighted protection areas that many corporations had beforehand missed or undervalued. Employment practices legal responsibility insurance coverage, for example, gained new significance as workplace-related claims tied for the highest inside danger at 47%.

The financial stabilization that allowed authorized professionals to focus past rapid monetary survival additionally created the muse for strategic insurance coverage planning. With inflation issues dropping from 52% to twenty-eight% as a main fear, corporations might redirect consideration and sources towards complete danger administration quite than crisis-driven price chopping.

Cyber Insurance coverage: From Non-compulsory to Important

Maybe nowhere is the insurance coverage awakening extra evident than in the evolution of cyber insurance coverage protection. The info reveals a dramatic shift in each consciousness and implementation of cyber safety, with uncertainty about protection dropping considerably throughout the career.

In earlier surveys, 23% of authorized professionals admitted they didn’t know if their present insurance coverage insurance policies would cowl towards information breach dangers. That determine has plummeted to only 3% in 2025, indicating not simply improved protection however enhanced understanding of what safety corporations even have in place.

The share of corporations with out devoted cyber insurance coverage has additionally dropped, from 22% to 14% year-over-year. Extra considerably, the variety of authorized professionals who consider their insurance policies would absolutely cowl towards cyber dangers has elevated from 26% to 33%, whereas these assured in partial protection jumped from 30% to 50%.

This displays the authorized career’s recognition that cyber threats aren’t hypothetical future issues however present-day operational realities. The mixing of AI instruments, elevated digital operations, and the delicate nature of authorized info have made cyber insurance coverage as basic to legislation agency operations as malpractice protection.

Does your legislation agency use AI?

On this webinar with Reminger Regulation Agency and Everest, we discover the use-cases of AI in authorized observe, one of the best instruments for the job, the dangers, and the advantages for attorneys.

The Threat-Taking Paradox

Some of the intriguing features of this pattern is its correlation with elevated risk-taking conduct amongst authorized professionals. Moderately than being defensive reactions to perceived threats, protection upgrades look like enabling bolder enterprise methods.

The info reveals that 37% of authorized professionals now view danger as a development alternative, greater than doubling from the 18% who held this attitude only one yr prior. This shift towards embracing danger coincides immediately with the growth of insurance coverage protection, suggesting that complete safety is offering the arrogance basis that permits strategic risk-taking.

This dynamic represents a complicated understanding of danger administration that goes past easy loss prevention. Consequently, authorized professionals appear to more and more view insurance coverage protection as a strategic asset that permits them to pursue alternatives they may in any other case keep away from as a consequence of potential draw back publicity.

The correlation extends to AI adoption as properly. The dramatic surge in AI utilization from 22% to 80% occurred alongside the insurance coverage protection growth, with many corporations possible recognizing that new applied sciences require new protections. Moderately than avoiding AI as a consequence of legal responsibility issues, authorized professionals look like addressing these issues by way of enhanced insurance coverage protection whereas continuing with strategic implementation.

Strategic Protection Planning

This insurance coverage pattern has created alternatives for authorized professionals to method protection planning extra strategically than ever earlier than. The secret’s understanding that insurance coverage buying selections ought to align with enterprise technique quite than merely assembly minimal necessities or business requirements.

Profitable protection planning begins with complete danger evaluation that goes past conventional classes to incorporate rising threats like AI legal responsibility, reputational harm, and evolving employment practices exposures. This evaluation ought to think about not simply present operations however deliberate enterprise developments and development methods.

The correlation between insurance coverage protection and risk-taking conduct means that protection selections needs to be built-in into strategic planning processes quite than handled as separate administrative capabilities. Corporations planning to increase AI utilization, enter new observe areas, or pursue aggressive development methods ought to guarantee their insurance coverage applications can assist these initiatives.

Common protection opinions have develop into important given the speedy tempo of change in each authorized observe and danger publicity. The authorized professionals who’re thriving within the present setting are those that deal with insurance coverage as a dynamic enterprise instrument quite than a static safety mechanism.

Regulation agency developments 2026: Wanting Ahead

This pattern positions authorized professionals to navigate future challenges with better confidence whereas pursuing alternatives that may beforehand have appeared too dangerous to aim. The corporations which have embraced this are constructing aggressive benefits that stretch far past easy loss safety.

The correlation between enhanced insurance coverage protection and elevated enterprise confidence means that the awakening will proceed to drive optimistic enterprise outcomes for authorized professionals who perceive insurance coverage as a strategic enabler quite than a needed price.

This shift represents only one aspect of how authorized professionals are essentially reimagining their relationship with danger, remodeling safety methods whereas embracing unprecedented alternatives for development and innovation.

Learn the entire Authorized Trade’s 2025 Threat Index to entry complete insights, detailed protection evaluation, and strategic suggestions for navigating the evolving authorized panorama with confidence and aggressive benefit.