What You Ought to Know

- Nationwide Common affords reductions for secure drivers of as much as 23%

- Save with Nat Gen’s anti-theft, low mileage, and secure driving reductions

- Policyholders who use an app to observe their driving habits can save

Does Nationwide Common provide secure driving reductions? Sure, it can save you as much as 23% for with Nat Gen secure driving reductions, akin to anti-theft, defensive driving, low mileage, usage-based, and secure driver reductions.

Study Extra: Low-Mileage Auto Insurance coverage Low cost

Prepared to check safe-driving choices for reasonably priced auto insurance coverage? Merely enter your ZIP code into our free quote comparability instrument above to get began.

Nationwide Common Affords Reductions for Secure Driving

Like many different insurance coverage firms, Nationwide Common affords secure drivers many auto insurance coverage reductions for reasonably priced protection. For example, it can save you when you have security options in your automobile or haven’t had an accident shortly.

Nationwide Common Auto Insurance coverage Reductions for Secure Drivers by Financial savings Quantity

As you’ll be able to see, drivers can save as much as 22% with the Nationwide Common insurance coverage secure driver low cost in the event that they go with no declare for a sure interval. Additionally, it can save you 10% for passing a Nat Gen-approved defensive driving course.

Maintain studying to be taught extra about every secure driving low cost in depth.

Examine over 200 auto insurance coverage firms without delay!

Secured with SHA-256 Encryption

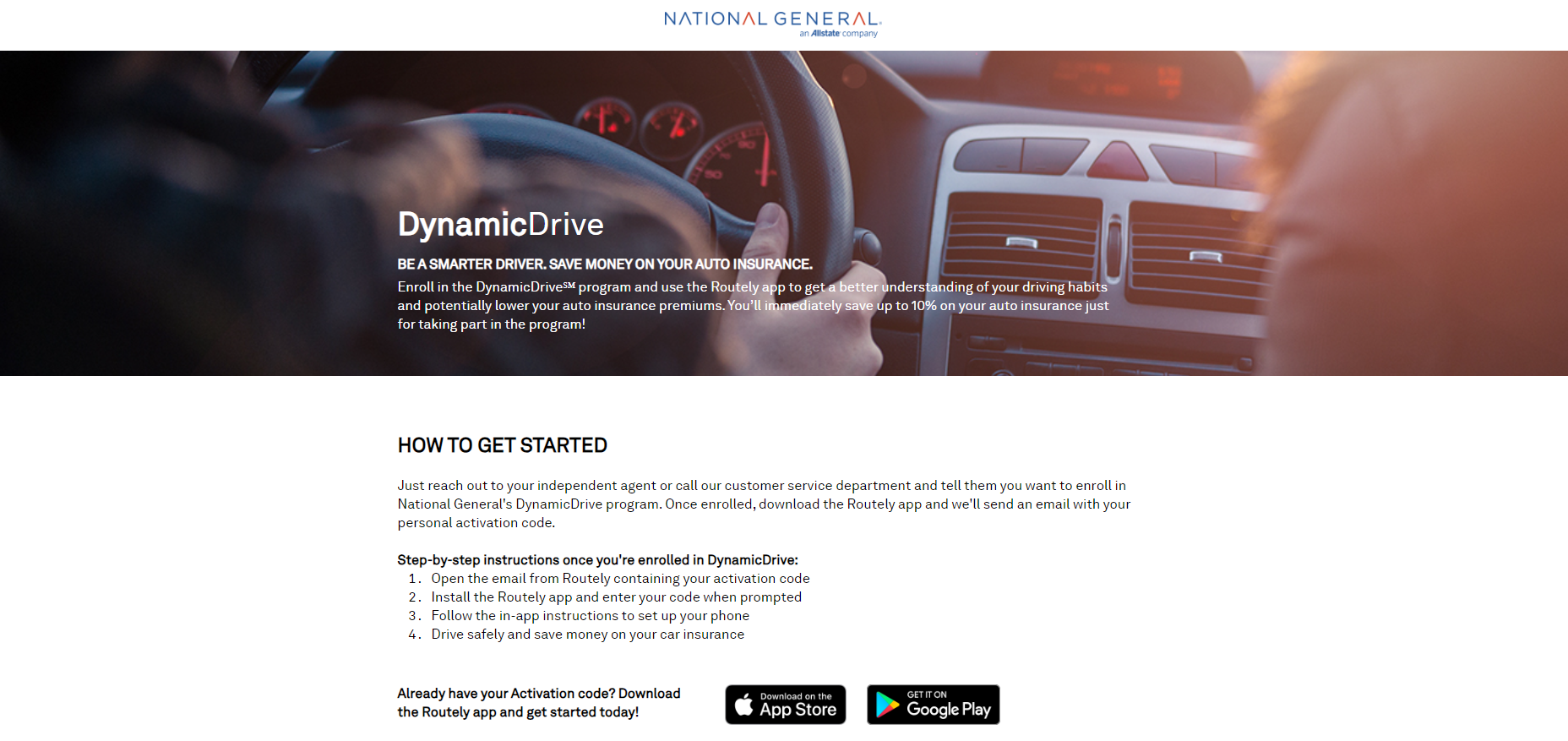

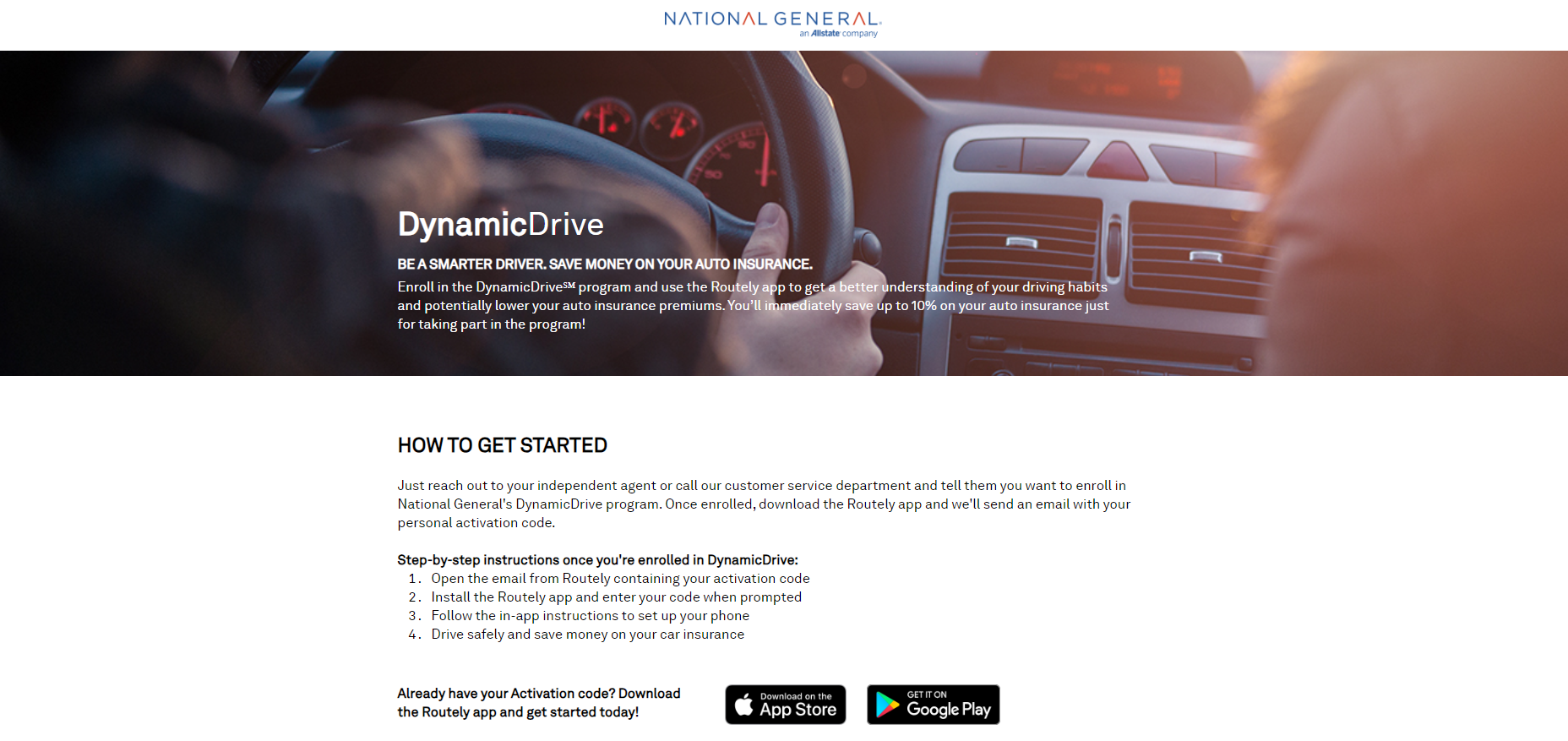

Secure Drivers Can Save With Nationwide Common’s DynamicDrive Program

Nationwide Common affords a usage-based insurance coverage program that rewards policyholders who use a monitoring app with decrease charges. This system is called “DynamicDrive,” which may decrease your automobile insurance coverage charges if it finds you drive safely.

Take a look at the desk under to see how a lot you may save with Nationwide Common’s usage-based insurance coverage vs. different high suppliers:

Utilization-Based mostly Auto Insurance coverage Financial savings by Supplier

To take benefit, you’ll want to enroll in this system and can then obtain an app on your iPhone or Android system. The corporate will then e-mail you an activation code which you enter into the Nationwide Common secure driving app.

After you have completed the setup directions, the app will ship the corporate knowledge about every journey you’re taking.

Should you point out that you are a safer driver by your driving habits, you may decrease your auto insurance coverage premiums. Nonetheless, enrolling within the Nationwide Common DynamicDrive program routinely saves you as much as 10%.

Brad Larson

Licensed Insurance coverage Agent

Should you don’t like the concept of gadgets routinely monitoring your driving habits, you could need to find out about reasonably priced auto insurance coverage firms that don’t monitor your driving.

Decrease Your Nat Common Charges With a Good Driving File

As well as, drivers who’ve fewer visitors violations over a given interval or make fewer claims might reap the benefits of decrease charges once they renew their insurance coverage. These charges will differ from state to state and buyer to buyer, so that you’ll must ask the corporate for particular particulars.

If you wish to know extra about violations and your driving report, be taught how a DUI impacts your auto insurance coverage charges, for instance.

Vehicles With Security Options Qualify for Nationwide Common Reductions

If eligible, you may additionally get decrease charges whenever you match security gadgets to your car that may cut back your danger. When your car already has sure security gadgets on board, it’s best to inform Nationwide Common so you could qualify for a reduction.

A few of these security options embrace:

- Air baggage

- Anti-lock brakes

- Anti-theft gadgets

Questioning how a lot an air bag auto insurance coverage low cost will prevent with Nationwide Common? Name a Nationwide Common consultant to be taught extra.

Examine over 200 auto insurance coverage firms without delay!

Secured with SHA-256 Encryption

Secure Drivers Get Low cost Nationwide Common Automotive Insurance coverage Charges

You possibly can reap the benefits of a number of packages providing reductions by Nationwide Common if you happen to can present that you’re a secure driver. For instance, you’ll be able to enroll and obtain an app to speak your driving habits to the corporate.

As well as, it can save you when you have fewer visitors violations or accidents or match sure security gadgets to the automobiles you insure.

Study Extra: Clear Driving File for Auto Insurance coverage

Nonetheless, the quantity it can save you will differ, and a few reductions will not be obtainable in all states. Enter your ZIP code into our free comparability instrument under to see how a lot secure driving reductions may decrease your Nationwide Common quote.

Often Requested Questions

How a lot is the Dynamic Drive low cost?

It can save you as much as 22% for good driving by Nationwide Common’s DynamicDrive program and a ten% low cost for preliminary enrollment. Nonetheless, Dynamic Drive with Nationwide Common may additionally increase your charges if you happen to drive poorly.

Does Nationwide Common have a scholar low cost?

What are the Nationwide Common reductions?

There are a lot of methods to avoid wasting on auto insurance coverage with Nationwide Common, by bundling auto with owners’ insurance coverage, paying in full, or qualifying for a low mileage saving. You can even profit when you have a number of automobiles in your coverage or select paperless billing.

Are you able to get monetary savings in your insurance coverage with higher credit score?

Some states characteristic a confidential rating the place they calculate an insurance coverage rating based mostly on sure components discovered inside a shopper credit score report. These firms might use this data to find out insurance coverage charges.

Are Secure Auto and Nationwide Common the identical?

Sure, in 2021, SafeAuto and Nationwide Common have been acquired by Allstate. Take a look at our overview of Allstate insurance coverage to see if the corporate is a proper match for you.

Why is Nationwide Common insurance coverage so low-cost?

Nationwide Common affords numerous methods for secure drivers to avoid wasting on their protection, together with with auto insurance coverage reductions akin to secure driver, good scholar, paid-in-full, and paperless.

Enter your ZIP code into our free quote instrument under to check your Nationwide Common charges towards the highest rivals in your space.

Can Dynamic Drive improve insurance coverage?

Sure, whereas most drivers get a reduction with DynamicDrive, you may see a surcharge when renewing if you happen to exhibit poor driving behaviors by this system.

What’s the low cost share for the great driver low cost with Nationwide Common?

You would save as much as 22% with Nationwide Common’s secure driver low cost if you happen to go claims-free for a sure interval.

Is NatGen Premier the identical as Nationwide Common?

Ought to I let insurance coverage observe my driving?

Permitting a automobile insurance coverage firm to observe your driving habits may result in decrease charges if you happen to drive safely. Nonetheless, it’s best to take into account your driving habits earlier than enrolling in usage-based insurance coverage.

Examine over 200 auto insurance coverage firms without delay!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance coverage Agent

Brandon Frady has been a licensed insurance coverage agent and insurance coverage workplace supervisor since 2018. He has expertise in ventures from retail to finance, working positions from cashier to administration, but it surely wasn’t till Brandon began working within the insurance coverage trade that he really felt at residence in his profession. In his day-to-day interactions, he goals to stay out his enterprise philosophy in how he treats hello…

Editorial Tips: We’re a free on-line useful resource for anybody fascinated by studying extra about auto insurance coverage. Our purpose is to be an goal, third-party useful resource for every little thing auto insurance coverage associated. We replace our website recurrently, and all content material is reviewed by auto insurance coverage consultants.