For a few years, the owners insurance coverage market operated as a comparatively secure and predictable sector in California. Modifications had been incremental, and the market largely catered to established patterns of threat and pricing.

This stability, nevertheless, has been disrupted lately, with dramatic shifts reshaping the panorama. The excess strains insurance coverage market has seen unprecedented exercise, and 2024 marks yet one more pivotal 12 months in its evolution.

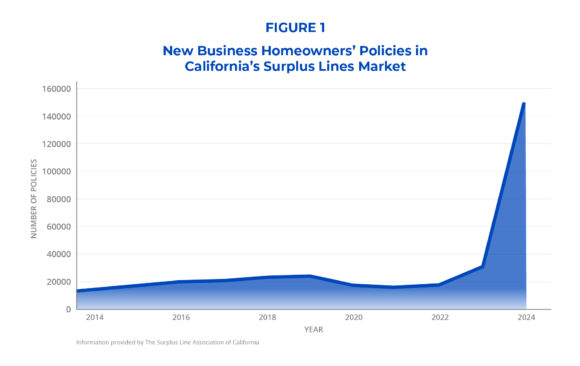

Constructing on the traits noticed in 2023, the excess strains market in California skilled exceptional development in new enterprise in 2024. The annual variety of new enterprise insurance policies elevated dramatically, from about 31,000 in 2023 to greater than 150,000 in 2024—a staggering development of 383% (Determine 1).

This sharp rise underscores the continued capacity of surplus strains carriers to fulfill the growing demand for owners insurance coverage protection left unaddressed by admitted carriers.

This development displays an enlargement within the sorts of properties at the moment being insured within the surplus strains market on account of admitted service withdrawals. Not like admitted insurers, that are strictly regulated and topic to charge approvals, surplus strains insurers function with extra pricing flexibility, permitting them to insure dangers that conventional insurers decline to cowl.

Traditionally, surplus strains owners insurance coverage insurance policies have been related to high-value, distinctive or high-risk properties, leading to bigger insurance coverage premiums, increased substitute prices and extra advanced underwriting necessities. Nevertheless, the info for 2024 paints a distinct image, one which aligns extra intently with the traits of insurance policies sometimes related to the admitted owners insurance coverage market.

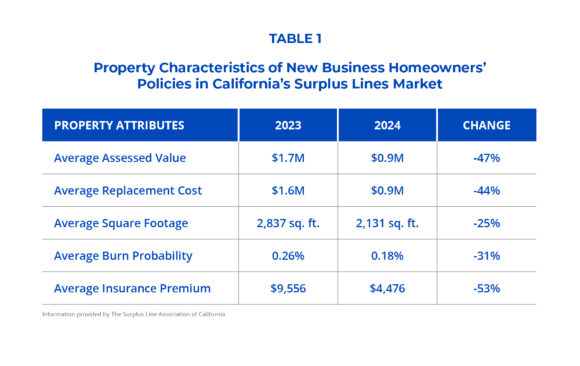

Information collected utilizing e2Value and the U.S. Division of Agriculture highlights vital adjustments in key property traits for brand new enterprise insurance policies in California’s surplus strains market.

Assessed values for brand new enterprise insurance policies in 2024 averaged $0.9 million, a big lower of 47% in comparison with $1.7 million in 2023. Alternative prices skilled an identical decline, dropping by 44%, from $1.6 million in 2023 to $0.9 million in 2024 (Desk 1). These reductions are substantial, indicating that the excess strains market is more and more insuring properties of decrease worth—properties which are much less advanced and had been as soon as comfortably throughout the scope of admitted carriers.

The shift can also be evident within the measurement of properties. The typical sq. footage of newly insured properties fell from 2,837 sq. toes in 2023 to 2,131 sq. toes in 2024, marking a 25% discount. Moreover, the common burn likelihood—a metric indicating the annual probability of a wildfire occurring at a selected location—has decreased by 31%, from 0.26% in 2023 to 0.18% in 2024 (see Desk 1). This decline means that the properties now coming into the excess strains market are in areas with decrease wildfire threat, reinforcing the notion that these insurance policies would have beforehand been positioned with admitted carriers.

On the identical time, insurance coverage premiums adopted an identical trajectory, with the common premium for brand new enterprise insurance policies lowering by 53%, from $9,556 in 2023 to $4,476 in 2024 (Desk 1). These declining insurance coverage premiums replicate not solely lower-value properties but in addition shifting threat profiles that extra intently align with the admitted market’s conventional scope. The convergence of smaller property sizes, decreased burn likelihood and decrease premiums additional helps the speculation that this development is being pushed by insurance policies displaced from the admitted market.

The withdrawal of main admitted insurers, together with Allstate and State Farm, has created vital protection gaps, pushing owners towards the excess strains market in its place. The properties now coming into the excess strains market replicate this shift, with considerably decrease sizes, assessed values, substitute prices, wildfire dangers and insurance coverage premiums—demonstrating the extent of admitted service withdrawals and the market’s want for different options.

On the identical time, the inflow of historically admitted market–sort properties adjustments the chance profiles of the excess strains market, requiring insurers to adapt their underwriting and pricing methods to accommodate this new actuality. The continued development and evolution of the excess strains market in 2024 serves as a response to rapid market pressures, however long-term stability is determined by restoring steadiness throughout the total insurance coverage system.

Gorshunov is a knowledge scientist for The Surplus Line Affiliation of California.

Subjects

California

Owners

Thinking about Owners?

Get computerized alerts for this matter.