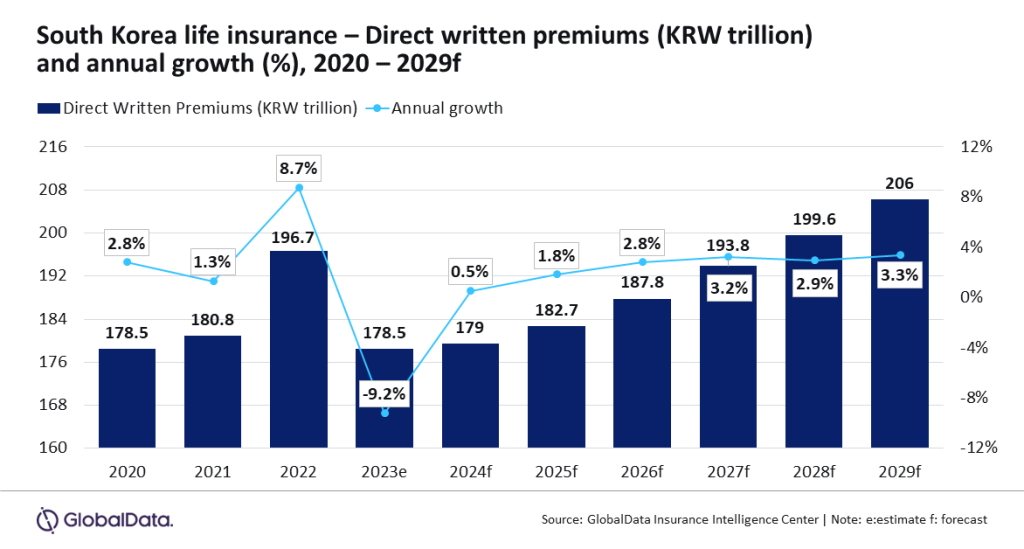

The life insurance coverage sector in South Korea is predicted to develop at a CAGR of three.1% from KRW182.7trn ($139.8bn) in 2025 to KRW206.2trn ($157.9bn) in 2029, when it comes to direct written premiums.

That is based on GlobalData, which additionally forecast that the life insurance coverage business in South Korea will regain momentum in 2024 and 2025 after declining by 9.2% in 2023.

Prasanth Katam, insurance coverage analyst at GlobalData, mentioned: “The South Korean economic system witnessed a slower development of 1.4% in 2023 that affected the demand for all times insurance coverage merchandise. GlobalData expects the economic system to rebound and develop by 2.2% in 2024 and 1.8% in 2025, which can help the demand for long-term and pension merchandise.”

Pension insurance coverage is the biggest line of enterprise, which is predicted to account for a 39.7% share of the direct written premiums in 2024.

As well as, it grew by 4.7% in 2024, pushed by secure market circumstances, resulting in increased returns on investments.

The Nationwide Pension Service in South Korea reported a preliminary return of 9.2% on its investments, amounting to KRW97trn ($70bn) in the course of the first 9 months of 2024.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

useful

resolution for what you are promoting, so we provide a free pattern that you could obtain by

submitting the beneath kind

By GlobalData

Moreover, the rise is basically attributed to robust efficiency in its international fairness holdings, prompting people to take a position extra funds of their pension plans. Pension insurance coverage is predicted to develop at a CAGR of 4.7% over 2025–29.

Complete life insurance coverage is the second-largest line, with an estimated share of 12.4% of the direct written premiums in 2024. It’s anticipated to develop at a CAGR of 1.2% over 2025-29, largely pushed by altering demographic components.

Katam added: “The South Korean life insurance coverage business is poised for regular development, pushed by financial restoration and altering demographics which are contributing to the demand for long-term care and pension options. The altering market dynamics will immediate insurers to supply insurance policies for the getting older inhabitants, that are prone to contribute to the business’s development over the subsequent 5 years.”